Buying Your New Zealand Home

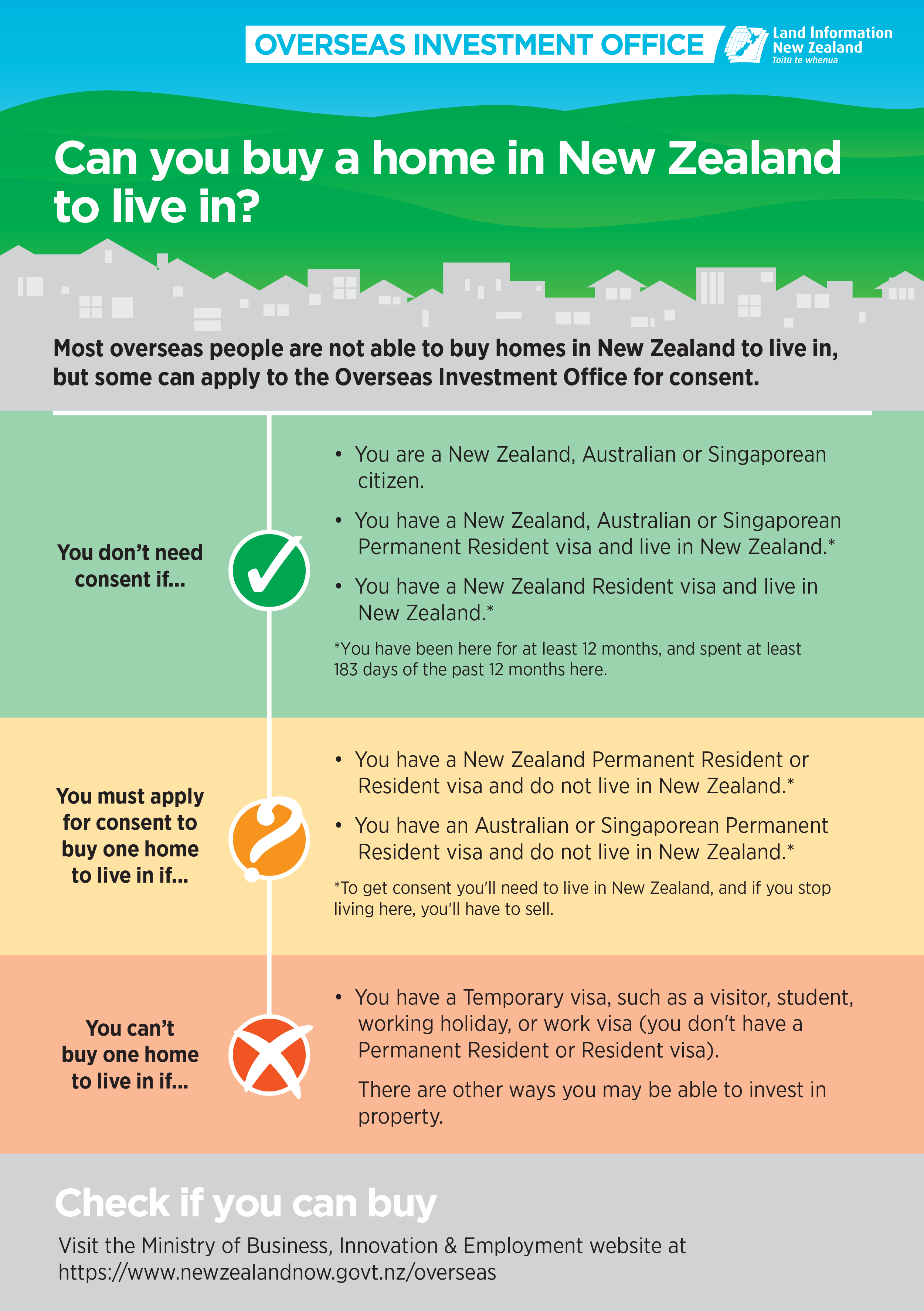

Changes to the Overseas Investment Act (2005) mean that most overseas nationals will generally be unable to buy existing homes or residential land within New Zealand.

However, under the new legislation, someone who holds a resident visa, and has been living here for at least a year — including at least 183 days in the past year — will still be able to purchase a home. (For more information, see newzealandnow.govt.nz/overseas .)

Excellent capital growth combined with low taxation levels means that New Zealand is reasonably safe for investment.

New Zealand does not have stamp duty, inheritance tax or problems with gazumping. Tax is only applicable if you are trading in property as a profession. However if you sell your property within five years of the transfer of title then it may be subjected to the IRD Bright-line test. Any profit on the sale will be taxed at a rate of up to 33%. www.ird.govt.nz .

Once a contract is "unconditional" the purchaser is by law required to settle on the property. The average time taken to complete a sale is four weeks with solicitors settling the sale on your behalf. Once a contract is declared unconditional by the seller’s solicitor then a 10% deposit of the purchase price is payable immediately by the purchaser.

To purchase a property in New Zealand you will require Proof of Identification (Notary Public witnessed), a New Zealand IRD number (Tax number), and a New Zealand bank account. You may require an overseas tax Identification number from the country of your primary income. You will also require a New Zealand based solicitor. Mortgages and loans may be available from New Zealand banks and it is possible to rent out your home and it is recommended to utilize the services of a Property Management company.

For information on current immigration policies, refer to www.newzealandnow.govt.nz . Foreign visitors may require a visa to visit New Zealand. Some countries are visa- free for a 3-6 month period in any one year or 9 months in 18 months. Please refer to www.customs.govt.nz .

Ways to Buy Your Home

New Zealand real estate agents are governed by the Real Estate Agents Act 2008. View www.reaa.govt.nz . Note:

- Client refers to the seller/ vendor of the property.

- Customer refers to the person buying/purchasing the property.

- Conveyance/exchanging contracts and settlement of the property are executed between the two parties' solicitors.

- A deposit of up to 10% is required upon an agreement being deemed "unconditional" but is often required at the conditional stage of the contract to indicate the purchaser's commitment to buying the property.

- Generally a prospective purchaser will work with one salesperson per office.

Contract For Purchase-Sales And Purchase Agreement

Agents have standard approved law society sale and purchase agreement contracts for making offers on a property.

Methods of Sale

By Negotiation Or Price

Agents have standard law society sale and purchase agreement contracts for making offers on a property.

A conditional contract is one which gives you a set time, perhaps one or two weeks, to sort out various aspects of the agreement. Clause conditions may include:

- Finance (so you can organize a mortgage)

- A valuation by a registered valuer if required for mortgage purposes

- A title search checking for easements, covenants or restrictions

- A Land Information Memorandum (LIM) from Council. The LIM is used to highlight anything that may not be permitted or consented

- A satisfactory builder's or engineer's report

The property owner may add an escape clause to any conditional offer, which means that if the client receives an attractive back-up offer, they give the first buyer a set time (about three days) to satisfy the conditions to make the first agreement unconditional.

The contract will specify the chattels to be left in the house (usually curtains, fixed floor coverings, dishwasher, etc) and a settlement or completion date. The settlement date is when you pay the agreed price in exchange for the key. Settlement is normally four to six weeks after the unconditional date although it can be earlier or later by mutual agreement.

Auction

To buy at a public auction you need to have any finance required approved by the bank as an auction sale is an

unconditional sale requiring the successful purchaser to immediately pay by cheque 10% of the sale price straight

after the bidding. Prior to the Auction date you would need to complete all your due diligence on the property. For

example obtaining and being satisfied with the LIM report, valuer’s report and approved finance. The sales person

will have certain documentation available including the approved Auction sales contract with details such as the

settlement date, etc., for you and/or your solicitor to peruse.

The owner will have set a confidential reserve price. An auction property cannot be sold “under the hammer”

until the bidding has reached that reserve. Once the bidding has reached the reserve, the auctioneer will say

“the property is now on the market”, competitive bidding will resume and will result in the top bidder buying the

property.

If the bidding does not reach the reserve price, the property is “passed in” to the highest bidder and negotiations

will continue with them until an agreement is reached. If negotiations are unsuccessful then negotiations will

continue with other interested parties.

Once the contract is signed you are legally obliged to complete the purchase of the property.

Tender

A tender is similar to an auction but without the public bidding. Essentially, you complete the tender documents

which have been approved by the seller’s solicitor. The purchaser will nominate the amount that you wish to pay

for the property. The Tender document must be accompanied by a cheque for 10% of the stated purchase price

as deposit. If your offer is unsuccessful then this will be returned to you. Tenders are sealed and opened on the

day the tender closes. All of the tender offers are opened and the most acceptable (if any) chosen.

For an owner, a tender gives the benefit of privacy as all interested buyers complete the Tender Sale and Purchase

Agreement and the sale price/ terms can remain confidential until the property has settled. The seller is not required to accept any of the tenders. If this situation arises they will ask the agent to negotiate with one or more

of the potential buyers to see if an agreement can be reached.

For this reason it is important to offer your best price if you wish to purchase the property. Unlike other methods of

selling you may not get another chance to make an offer.

Unlike the Auction process you are able to insert conditions to the offer, much like a negotiated sale — but

remember that a cleaner offer is always most attractive to the seller.

Settlement of Your Property Purchase

Prior to settlement day you are entitled to a pre-settlement inspection of the property. This is to check that the property is in the condition that you saw it in between signing the contract and moving in and that the agreed chattels remain.

If you do notice a problem, inform your solicitor who will contact the seller’s solicitor. Once settlement has occurred the seller’s solicitor will authorize the release of the keys to the house and you are able to move in. Please be aware that often the key is not released until late in the day.

Once your offer to purchase is declared unconditional by your solicitor (e.g. finance, valuation, builders report conditions have been satisfied) your solicitor will:

- Prepare your mortgage document and explain them to you

- Prepare the Memorandum of Transfer, which transfers ownership to you

- Check that the council rates and any other costs are not in arrears

- Confirm that you have arranged insurance for your new home from settlement date

- Searched the property title from Land Information New Zealand (LINZ), which is a protection by statute against somebody else making a claim against the title to the property you are buying

- Arrange with you and your bank for payment of your loan and your remaining share of the purchase price (excluding your deposit)

- Arrange for you to collect the key to your new home – note that on many occasions the key is not authorised for release until late in the day. A tip – don’t settle on a Friday.

After settlement, your solicitor will:

- Provide you with a new settlement statement containing all the details of the purchase

- Register the new mortgage and the transfer of the title with the LINZ office

- Give you a copy of the title showing you registered as the new owner

- Report to your lender that the mortgage has been registered and provide a copy of the title and certificate of insurance as confirmation of security for your loan

Purchasing Residential Property In New Zealand

Please note that you must seek the advice of an appropriate professional.

Who Can Purchase Property in New Zealand?

Overseas persons must receive approval from the Overseas Investment Office. See https://www.linz.govt.nz/overseas-investment .

Entry to New Zealand

How long can you stay in NZ?

The maximum stay with a visitor’s visa is nine months in any 18-month period. To extend the time period contact Immigration New Zealand.

The maximum stay for citizens of visa-free countries (includes UK Citizens) is three months per visit (six months if you are from the United Kingdom) and no more than six months in any 12-month period. Source: NZ Customs visas www.customs.govt.nz .

Those wishing to stay longer per visit should apply for a visitor’s visa. See www.immigration.govt.nz .

Ownership of a property does not entitle you to residency or citizenship and you are subject to the standard immigration application. You are not entitled to work in New Zealand unless a work permit is granted.

Property Purchase Requirements

If I am able to purchase a property, what will I need?

All documentation may be electronically transmitted. However, all legal documents must be witnessed in front of a Notary Public in their country of residence. This will include the Sales & Purchase Agreement and copy of confirmation of identification (passport).

- Confirmation of Identity Document signed by a Notary Public.

- A New Zealand based solicitor.

- New Zealand Bank Account.

- IRD (Inland Revenue) Tax number www.ird.govt.nz , complete form IR742.

- Overseas Tax Identification Number (TIN) from country where tax is paid on all income.

- You are not required to be physically present in New Zealand to purchase a property.

- Confirmation of Identity Document signed by a Notary Public.

- You are not required to be physically present in New Zealand to purchase a property.

- A licensed real estate agent as defined under the Real Estate Agents Act 2008. NZ licensee salespeople/agents are governed by this legislation (REAA 2008).

NZ Property Terms

What are the contractual obligations?

Conditional contract – the sales & purchase agreement has conditions of sale to be met by a finite date before the property is declared unconditional. The contract can be cancelled if the conditions (and only on the conditions of sale) are not met by the agreed date. Note that the seller may still have an opportunity to remedy the condition thereby declaring the contract unconditional.

Unconditional contract – all conditions (if any) have been met. The purchaser cannot cancel the sale after the contract has been declared unconditional by the seller’s solicitor.

Deposit requirements – as a sign of good faith a 10% deposit of the sale price may be required upon entering into a conditional contract. This is refunded if the contract is cancelled should the conditions are not be satisfied. A 10% deposit is required on the day that the property is declared unconditional by the seller’s solicitor.

Taxable Income

Is tax payable on the property?

New Zealand does not have:

- Stamp duty.

- Inheritance tax.

- Capital Gains tax – NB: Bright-line test requirements.

- Bright-line test: If the property is sold within five years the Bright-line test calculation will span the period of acquisition (date of transfer) of the property to the date of disposal. The property may be subject to 33% tax on any profit.

Rental income is liable for tax payment. An annual tax return will be required. Further tax implications if buyer is a developer or builder.

Anti-money Laundering Requirements

As from 1 January 2019 all real estate agents are required to verify the identity of Vendors as required by the Anti-Money Laundering and Countering Financing of Terrorism Act 2009 Act 2009. Click here for details.

Every precaution has been taken to establish the accuracy of the material herein but no liability can be accepted for any inaccuracies. Prospective purchasers should not confine themselves to the contents but make their own enquiries to satisfy themselves on all aspects.